Overview

- Company founded in 1961 and profitable every year

- Proprietary products drove strong customer relationships and recurring revenues

- Founder limited growth to a lifestyle business resulting in low penetration of a large potential market (100+ U.S. pulp mills and untapped mining market)

- Attractive EBITDA margins

- Management buyout completed by Former Dow Chemical executives with The Courtney Group and Cave Creek Capital in August 2007

Results

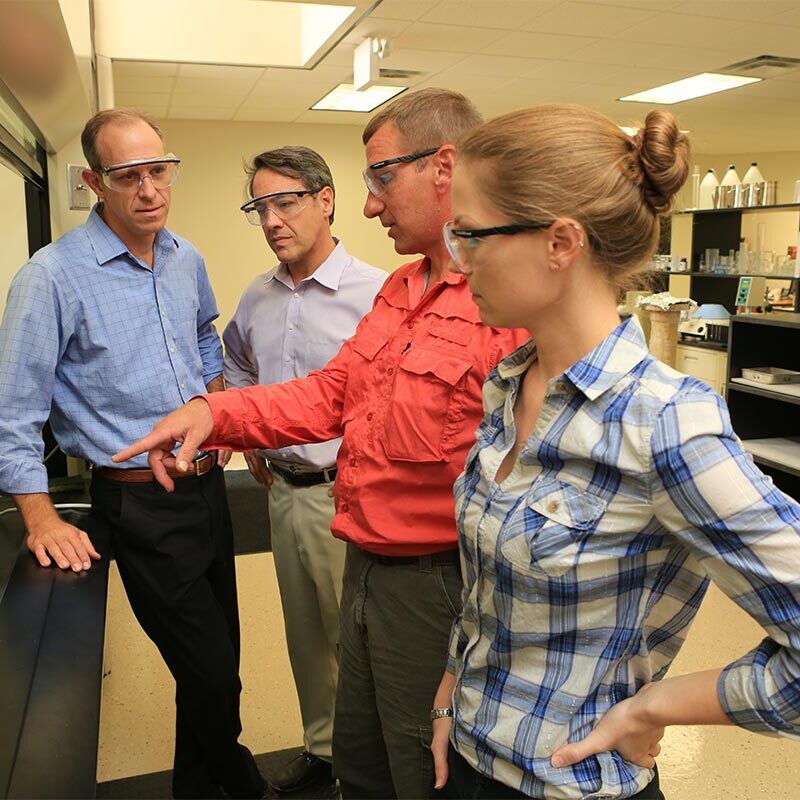

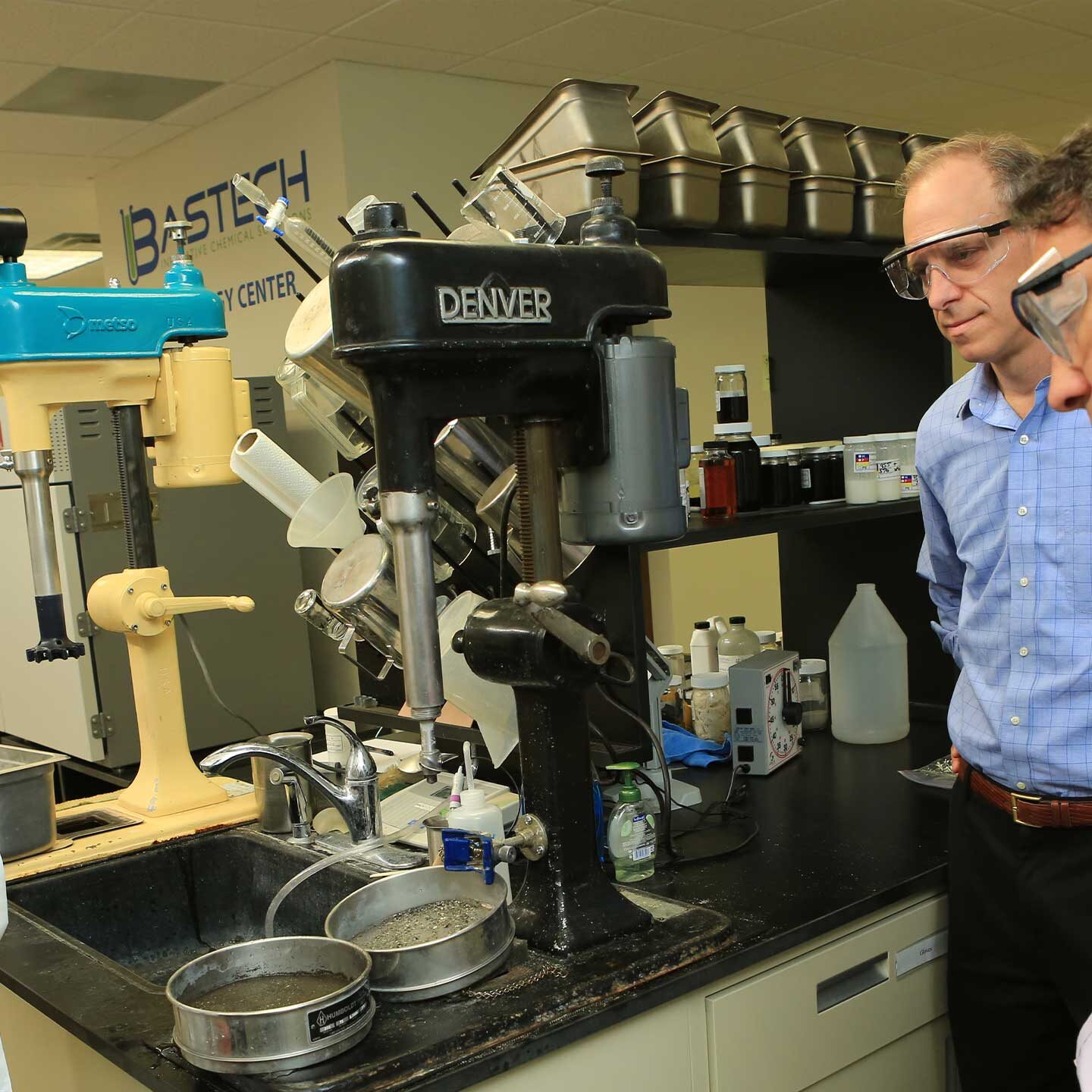

- Substantial investment made to expand Company’s facilities, marketing, and administrative systems

- Hired additional Senior Executives; tripled existing team

- Expanded R&D programs with several existing products and several under development

- Expanded mining effort to become leader in US phosphate mining sector

- Launched international sales effort

- Sales have grown 300% since closing

- Customer base has increased 400%

- Cash Flow (EBITDA) has increased over 100% in four years

- Recapitalized Senior and Subordinated Debt with SunTrust in February 2012

- Management team expands in conjunction with debt recapitalization in 2014

- Lower leveraged company continues to to invest in paper/pulp and mining markets

- Expansion into international markets with joint ventures with major chemical companies attracted by Bastech’s technology