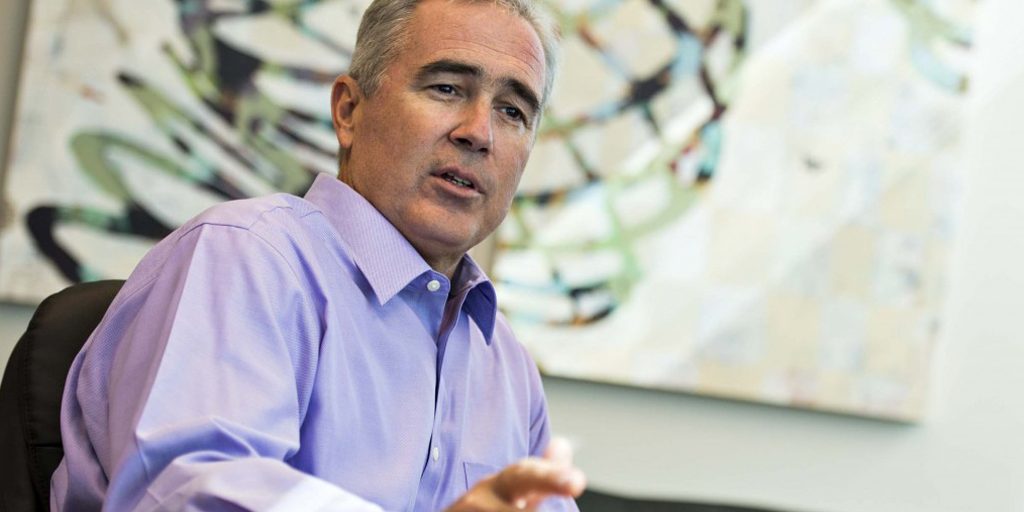

Mark Harshbarger, former CFO and COO of Philosophy, talks to us about his experience helping build one of the most successful cosmetic companies in the USA

K: Mark, thanks for coming in.

M: You’re welcome!

K: For the benefit of our CEOs, we want to showcase the success that you’ve had with Philosophy and talk about the lessons you learned. So why don’t you start by telling us about your role with the company.

M: I worked at Philosophy for a little over ten years. I held several positions, but for most of the time I was both the CFO and the COO. The founder was basically the visionary and the leader of the firm but in terms of executing the day to day operations, that was me.

K: What was the biggest hurdle you faced in growing Philosophy?

M: Philosophy was an exciting company to work for. It had a very small revenue base when I joined and it grew to be a very nice sized organization when we sold. And it was growing rapidly so it did have many challenges. The biggest was how to maintain the sales growth but not grow beyond our capacity to serve the customer and the consumer. You only have one chance to make a good first impression and since we were growing so fast we had a lot of first impressions and I wanted them to be solid, good, and lasting.

K: At what level of sales did that hurdle start to become apparent? 20 million, 50 million, 100 million?

M: We started to have serious growth pains right around the $30 million range. When we were at the $10 to $20 million level, we were fine. But when we went from $30 to $60, $90, and $120 million we started to face many challenges, particularly because we were making those jumps on an annual basis and also the fact that we were manufacturing 90% of our product.

I would recommend to anyone growing a business that you have to understand what your strengths are, what your weaknesses are and let your ego stay at the door…if there’s a weakness, go get help and don’t hold back.

K: How did you choose people to hire and promote?

M: That’s an interesting question because at the time when we started or when I came on we were a small enough company we did not have the ability to go hire the “big talent” out of a major city. So what I looked for, especially given the culture that we tried to nurture at Philosophy, were individuals who fit that culture. There was the question of, “Did they have good teamwork and good chemistry”? It was almost like a sports team because if you have a bunch of stars that don’t play the same play, you are going to lose. I wasn’t worried about having a lineup of stars, I was more worried about having a team of winners.

K: So how did you determine if a candidate was a good fit?

M: I listened for a variety of key phrases and words were indicative of where they were coming from: integrity, loyalty, family, respect. There were about eight or nine of them in total. In an interview I would explore those types of characteristics because I wanted to make sure that you, as an employee, weren’t worried about your career number one or your department number one. Then you weren’t going to be a member of the team. Glory couldn’t be to you. The question was, “Could you focus on the growth of Philosophy and work as part of the team”?

K: How big was Philosophy in sales and employees when you sold?

M: When we sold we were approaching the $150 million range and 300-400 employees. Since we manufactured our product, the actual number could range from season to season depending on the number of temp employees that we had at the time.

K: When did you know it was time to sell?

M: It was easier for me to ascertain when it was not time to sell. Philosophy was growing and was a niche brand and for years there were a lot of people that wanted to get in and buy it from us. I knew from a valuation standpoint that we were growing at such a fast pace that our profits were going to grow faster in the years to come. Even though I had faith in that, I had doubts that we could effectively communicate that to outside buyers and to get the true multiple of future earnings that we wanted. So I knew when we shouldn’t sell. When we were in the $60-$90 million range, it was too soon. We were just starting to leverage our overhead and our ability to grow profits. Our revenues were growing at a very fast rate and on the margin; your EBIT is going to grow a lot faster. Now in terms of deciding when to sell, I intuitively knew when to sell based on my abilities, the company’s abilities, and the staff’s. You get to a point where you’ve almost outgrown your organization with the staff you have and it‘s time to go out and get outside help. We had reached a point where it was time to say that we’ve taken this about as far as we can go, let’s get some outside help that can help us take this to the next level.

K: With the parade of Private Equity firms coming in how did they differentiate themselves and why did some of them do better than others in that process?

M: Well it’s interesting when I look back at the Private Equity firms. Ones that struck a chord with me were similar to the types of employees that we hired. Since we were going to sell the entire organization, we viewed them almost as a future employee and really sought out team players. I wanted a team that could fit into our culture, fit into our work style, and there definitely was a difference between many of the firms. Ones that had the attitude, “Okay, we’ve arrived and we’re taking over,” I wasn’t interested in. But the ones that said, “We like what you have going on here and we want to partner with the strengths that you have and offer the strengths that we have and make the company a better company moving forward,” that was very interesting to me.

K: Any big mistakes that turned you off from some of them?

M: The ones that would turn us off were the ones that would come in and appeared too overly confident or even arrogant. I’m not an arrogant person. I know that I have my own strengths and weaknesses, but I know anyone else coming in the door has their strengths and weaknesses too. So, I just felt it was a mistake when they came in and assumed they were “the gift to the world.” And it doesn’t mean that is always bad thing. It’s just my personal opinion that I find it to be very difficult to partner, move forward, and grow the company with those types of personalities.

K: Looking back now, would you do anything differently over those 10 years?

M: I tend not to be a person that worries about mistakes or things that you did wrong because I find that to be counterproductive. When things don’t happen properly, I tend to focus more on what can you learn from that opportunity and don’t beat yourself up for the past. One of the things that I would have done differently is I would have focused on international growth. I’m not going to beat myself up for it, but I think we missed the ball on developing the brand internationally.

K: Are there any other lessons that you took away from the experience?

M: I would recommend to anyone growing a business that you have to understand what your strengths are, what your weaknesses are and let your ego stay at the door. You have to understand what you’re good at and what you’re not good at and go get outside help. The goal shouldn’t be your own ego, the goal should be growing your organization as fast as you can from a revenue standpoint, cultural standpoint, social standpoint, and a profit standpoint, and if there’s a weakness, go get help and don’t hold back.

K: Thank you very much.

M: Great, thank you for the opportunity.